Financial Frauds on Mobiles

In the most recent few years, cases of online different kind of frauds are ever-increasing rapidly in India. There are numerous Cybercriminal available creating gangs of their own actively ready to make you their victim and fetch your data as well as money from your personal account. Nevertheless, you have to be conscious and aware to avoid chances of frauds.

RBI coveys about sharing of personal details by the customers, deliberately or naively, is one of the main causes leading to the financial frauds. Cybercriminals are thieving credentials using a great range of techniques, tactics and procedures.

There are some common Types of Cyber Frauds and the Preventive Measures to be Adopted

*SIM Swapping / SIM Cloning

Through SIM swap, we basically mean changing mobile SIM cards.

SIM swapping happens when fraudsters contact your mobile phone’s carrier and trick them into activating a SIM card that other person has.

After this, the scammers may have control over your phone number. Anyone calling or texting on your number automatically known to the scammers’ device as well

With the help of operated fraudsters’s SIM, they can get One Time Password (OTP) and other alerts essential to take out personal details and financial transactions through your bank account.

Do

-

- Be cautious of fake emails, links and other ways attackers.

- Improve your cellphone’s account security with a unique, strong password and strong.

- Set a separate passcode or PIN for your communications.

- Use the technology that analyzes customer behavior to help them discover compromised devices.

Don’ts

- Don’t build your security and identity authentication solely around

- Do not share your confidential details with anybody or any other websites.

Frauds by compromising credentials through Search Engines

An individual or any other firm use search engines to create crime and get personal details and contact details of other people cell phone numbers of their bank, insurance company, Aadhaar updating centre etc. The other party’s contact details on search engines frequently do NOT belong to the respective person or organization but are shown and made to appear as such by fraudsters.

At the end, Victim may end up contacting unknown / unverified contact numbers of the fraudsters displayed as bank / company’s contact numbers on search engine. Considering the fraudster to be an authentic representative, customers allocate their secure details and thus fall into financial frauds.

Do

- Always get hold of the customer care contact details from the official websites of banks/companies.

- Do refer that the Customer care numbers are never in the form of mobile numbers.

Don’ts

- Do not revert back or call the numbers directly displayed on the search engine

- Don’t click on the websites often feature cheap products and incredible deals to lure unsuspecting online shoppers

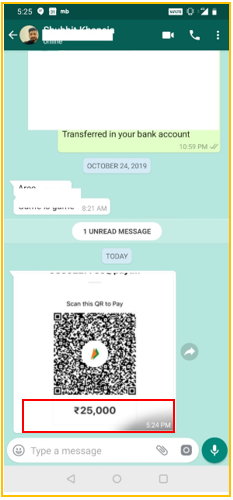

Scam Through QR CODE Scan

Online Digital scams for the purchasing and selling all the way through QR codes are one of the most widespread methods, cybercriminal use to plot the plan to get the money illegally from the innocent people with the help of QR codes. Being a beginner in online selling, people usually scanned the QR code with purpose to receive the money or complete any transaction, but eventually gets financially lost instead. Much to their disclosure, the fraudsters had the courage to tell him to scan another QR code to receive the money which was sent unintentionally.

As soon as you scan the QR code, instead of the amount being credited, it will get deducted from your bank account at that point of time and the money will be automatically transferred to another fraudsters’ account.

-

Do’s

- Deal in cash if possible

- On platforms like OLX, you should check if the user is genuine

- Be alert in dealing

- Educate yourself about the importance of QR code.

- Report the incident to the cybercrime immediately n inform the bank too

-

Don’ts

- Never share your UPI ID or bank account details

- Never share OTPs

SMS/ Email /Instant Messaging/Call scams/Online Job fraud /Work from home Job frauds /Social websites fraud/ Betting fraud

While the SMS/call scam, Online Job fraud and other scams industry in India has been booming for years, the last year has seen a surge due to pandemic-led jobless and nervousness amongst job seekers. These frauds continue to occur owing to acceptance, ignorance and anxiety, which is necessary to know about the various types of job around you.

Fraudsters circulate bogus messages in instant messaging apps/SMS/social media platforms on eye-catching loans, services, online jobs and use the logo of any known NBFC as profile picture in the mobile number shared by them to tempt credibility. They also fake as officials of a reputed company(s) and offer employment after conducting fake interviews. Following sending such bulk messages/SMS/emails, the fraudsters call random people and share fake sanction letters, job offers, work from jobs, copies of fake cheques etc., and demand diverse charges. Formerly the victim gets convinced and pay these charges, the fraudsters/criminal abscond with the money.

-

Do’s

- Never open/respond to emails from unknown sources

- Be aware of suspicious looking pop ups

- Always check for a secure payment gateway

- Keep the PIN (Personal Identification Number), password, and credit or debit card number, CVV etc. confidential

- Avoid saving card details on websites/devices

- Turn on two-factor authentication

-

Don’ts

- Do not believe fake loan offers from personal numbers

- Do not use same passwords for your email and internet banking

Fake vaccination Call and Fake Covid-19 testing call Fraudulent Coronavirus Tests, Vaccines and Treatments

Though we stay attentive to look after and protect our families and communities from COVID-19, some people might be tempted to buy or use doubtful products that state to help diagnose, treat, cure, and even to provide free vaccination to prevent corona virus disease. Keeping the fraud in mind, the U.S. Department of Health and Human Services Office of Inspector General is alerting and warning the society about fraud schemes linked to the novel coronavirus (COVID-19).

The fraudsters/ criminals usually use testing sites, telemarketing calls, text messages, social media platforms, and door-to-door visits to commit COVID-19-related scams and fake vaccinations calls. They are offering COVID-19 services in swap over for personal details, including Medicare information. The provided personal details can be used to fraudulently bill federal health care programs and commit medical identity theft.

-

Do’s

- Be careful of any COVID-19testing site

- Be aware of advertisements for COVID-19 testing or treatments

- Always book registered labs for any kind of test

- Report to the nearest Cybercrime Police station or Portal further help

-

Don’ts

- Do not purchase or reproduce fake COVID-19

- Do not share your Aadhar Card or any other Pin Code